Pick Best stock in Market Crash for short Term Investment: 6 Golden Rules.

Every body is a faired about market crash . Stock market is one of the best choice to invest money directly into the market but there are misleading about stock market that this area of investment is very risky for hard and earn money . Definitely stock market is very risky for those who invest by some tips and take decision to invest money through any news or tips ,that type of people called speculator ,on other hand if there is proper study done than it is one of the most way to build money in compounding way.

In this articles I will explore some golden rules how we can pick stock in falling market by proper analysis and knowledge .

These rules can be followed for shot term investment journey.

Golden Rules in stock market crash for short time investment.

Here are some golden rules to pick stock when all the investor may in fear about market crash .

Rule no 1-Proper news analysis and Find the market crash reason .

When We are Going to invest for short time period in the market crash than it is time to analyse current stock market news, both national and globally news directly or indirectly leave its impact on market crash if there is global issue . highly chances to stay with side line trend for long term.in the falling market it is importend to check proper reason of market crash ,if the reason is nothing more special and all demand is fulfilled than it can be consider for short term investment with proper analysis .

During the market crash many stock are available on discount prices so it is important to pick best stock which may generate good return either in short term or if not than it definitely generate in long term.

Rule no 2 Always consider Fundamental stock company.

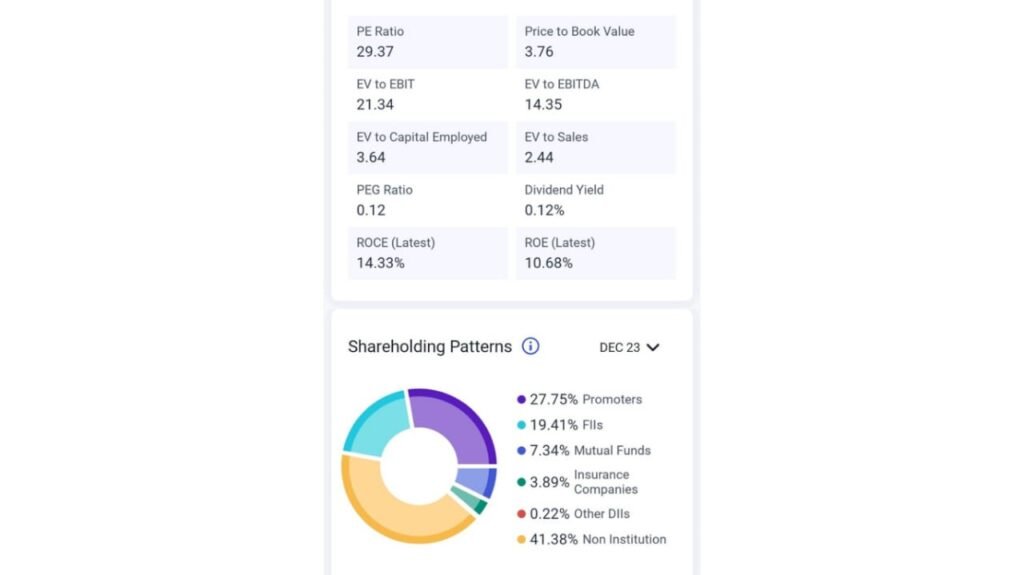

During the market crash this rule may consider as a priority base ,if we choose fundamental strong company without any fear, definitely it give good return in near future .

One thing to be remember that fundamental stock growths may slowly so may generate return in low volume .also keep in knowledge result of company for that financial year. We are trying to stock for short time so proper fundamental will be study for safe return.

Role no 3 Follow the Market Trend.

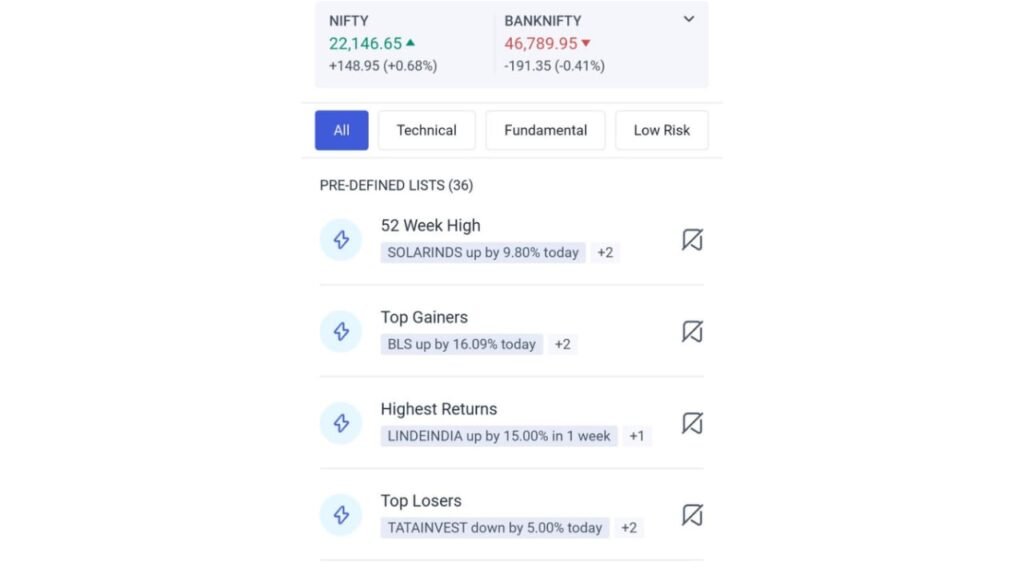

It is said that “Market trend is your friend” so always go with market trend if market is bullish then consider stock in portfolio which are available with uptrend only .

Always try to avoid down trend stock ,these type of stock may be big reason of capital loss.

It is also seen that stock should be down 30-40% down from its 52 week high level .there will be great chance to recover soon in near future and it will generate a good return .stock which are in uptrend always make better return in portfolio.

Rule no 4 Technical Analysis study.

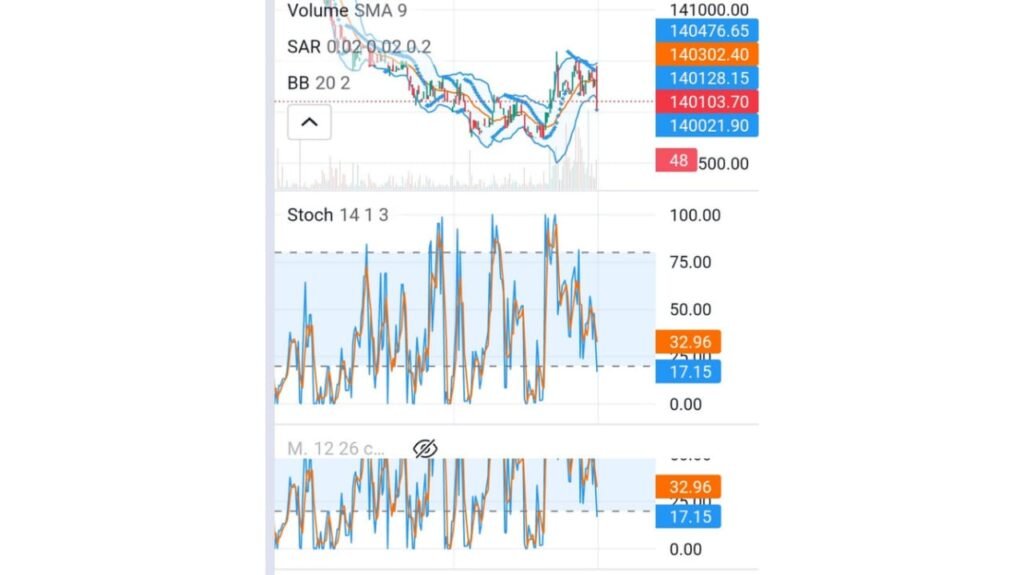

Mainly in the short term investment period technical analysis has its unique role ,by using many indicator we can predict about support and resistance level for the stock for investment .

If there is great signal by three and more than two indicator along with support and resistance level prediction , it may pick for good investment in short term .

We also can consider candlestick chart pattern for technical analysis in journey of stock pick during market crash .

Rule no 5 Always Pick debt free stock with Promoter holding More than 50%.

If all above said criteria is correct than try to pick only debt free stock company along with promoter holding more than 50% whether it is current and long term borrowing .

If there is short term borrowing with the good growing company it may be pick for investment in short term .

Always avoid company which have both short and long term borrowing more than company total assets.

It may also Avoid promoter holding pledge stock for investment .

Role no 6 Honest company Management and Future oriented Business.

It should be analysis about company management and company business should be future oriented . all product and services may belong to their use in circle of competence area.

Good and management always thing about company growth and if there is company growing it will result to generate good compounding return in future .

Conclusion

Stock pick may be great decision when market is going down ,it is very fearing stage so I also recommend not to invest whole capital in sum amount ,always make it in instalment basis because no one know bottom of the market .make your own analysis before investing in short term period .don’t follow any fake news or tips .a financial adviser can be great choice for safe investment .